Business Services

Accounting & Bookkeeping Services

Modern business demands accurate, up to date financial information.

We can relieve you and your staff of an enormous burden by taking care of all of your bookkeeping and accounting needs, including the preparation of your annual accounts and periodic management accounts for tax, business appraisal and planning purposes.

We will discuss your requirements with you and provide you with tailored information and constructive advice on a regular basis.

Benchmarking

Have you ever wondered how your business performs compared to your competitors? Are you spending enough on advertising ? Are you paying too much rent? What is the average bottom line of your competitors?

Survival in today’s business climate requires you to spend more time working on your business rather than in the business.

We can provide you with accurate, timely and information benchmarking reports – allowing you to see how your business compares against your competitors, understand how the rest of your industry works and analyse the key performance indicators of your industry.

Budgeting

A good budget is a necessity for a good business plan. It is one of the best business tools we have, which allows us to set financial targets and measure our performance.

In addition to its goal-setting value, budgets will often improve your chances of acquiring funding. Financers often require budgets as a prerequisite for funding approval.

The techniques we utilize in the formation of financial projections will allow you to consider future scenarios and give you goals to strive for in your business. There are many types of budgets, and we can help you design the right budget for your needs and requirements.

Let us show you how a budget is able to provide feedback to allow you to prepare for the future.

Business Start-Up

Let us help you turn your business idea into a reality.

If you have a good idea for a new business venture but don’t have expertise in the legal or financial aspects of creating a new business, we can help you:

- Decide on the most suitable structure for your business – sole trader, partnership, or limited company

- Prepare a business plan, cashflow projections, budgets, and trading forecasts

- Assess your finance requirements, advise on the best sources of finance, and draw up the necessary proposals

- Establish a good working relationship with your bank

- Register for an Irish Company or Business Registration Number with the CRO

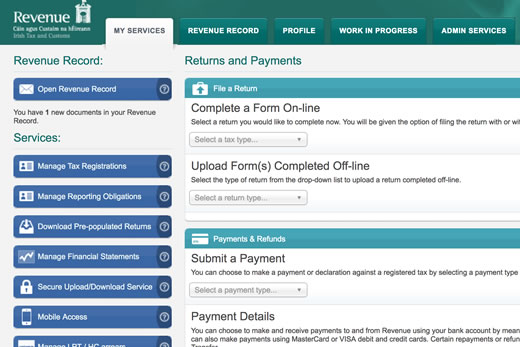

- Complete registration procedures with the Irish Revenue Commissioners

- Set up a recording system for your internal use and for complying with Irelands statutory requirements

Cash Flow Forecasting

Have you ever wondered if you are holding too much inventory? Is this the right time to expand your business? Are you going to have enough cash to pay all expenses every month?

Survival in today’s business climate requires you to spend more time working on your business rather than in your business.

We can provide you with accurate, timely and informative cashflow forecasting reports – allowing you to:

- Realise and understand when cash is available

- Plan and prepare for expansion, stock control, and taxes

- Analyse and anticipate key expenses

- Armed with this information, we’ll work with you to develop appropriate action strategies to improve your bottom line

Financing

A wide range of financing options exist, all with their pros and cons. At SBL Accountants, we know the financial market and have the experience to assist you in securing the best financing option for your personal and business goals. Our experience in the market means we are also able to structure debt upon acquisition to maximise tax advantages.

Let us explore the best financing options with you, to help get your business closer to its goals.

Management Consulting

Our aim is to ensure your business achieves the potential it’s capable of. We have the know-how and the experience to offer advice that will help you run your business more effectively.

We are practiced in acting as a sounding board for management, bringing to the relationship years of experience in business growth. We can identify key performance indicators in your business, through which you will see the positive changes taking place with the help of our professional consultants.

We are able to check that your business is as competitive, focused, and profitable as it can be. We then offer flexible strategies designed to address the issues affecting your business.

Let us give your business a health check. Take the practical advice we can give to ensure the continual success of your venture.

Part Time Financial Controller

Many business require a Financial Controller but do not have the capacity or resources for a fulltime F.C.

SBL can provide you with a part time F.C. on a basis that suits your requirements.

Contact us to discuss how our financial expertise and experience can assist to grow your business.

Payroll Services

Administering your payroll can be time-consuming and divert you from the core activities of your business. In addition, payroll & employment legislation is growing increasingly complex.

We can relieve you of this burden by providing a comprehensive and confidential payroll service, including:

- Customised payslips

- Administration of PAYE, PRSI, USC, annual leave etc

- ROS P30, P35 filing

- Summaries and analysis of staff costs

- Administration of incentive schemes, bonuses and termination payments

Even if you only have a few employees, you will make savings by engaging us to administer your payroll.

Software Solutions

Let us help you make the right choice when it comes to accounting software.

A suitable accounting system will streamline your processes, help you keep track of your cashflow and allow you to complete Revenue (ROS) Returns much more easily.

Choosing the right system for your business can be a difficult one – after all there are many different accounting packages available in Ireland. Here at SBL Accountants, we have invested considerable resources into on-going training to ensure we are able to recommend the best accounting solution for your business.

Strategic Planning

The pressures of daily business operations can often lead to strategic planning taking a back seat – but to have a successful business you must plan ahead.

We’ll help you establish a strategic plan that looks at where you want your business to be in the next 3-5 years, and exactly how you and your team can achieve these aims and objectives.

Your strategic plan will:

- Define the characteristics of your company in three to five years

- Identify your competitors

- Define your objectives and financial goals

- Put in place an effective implementation plan to achieve your goals

Tax Services

V.A.T

The VAT system is a complex and confusing one. For this reason, SBL Accountants ensures it’s continuously up to date with changes, in order to offer you accurate advice.

Every transaction now brings with it a VAT issue. We have experience with these issues and are able to offer expert advice concerning the implications of VAT on your business. The VAT related services we offer include, but are not limited to:

- Advice on registering for VAT

- Filing and adjusting VAT returns

- Revenue audit assistance

Taxation

SBL provides professional tax services in a personalised manner to individuals and business.

The services we offer include:

- Income Tax

- Corporation Tax

- Capital Gains Tax

- Capital Acquisition Tax

- Tax Advice

- Tax Planning

Revenue Returns

At SBL Accountants, we offer a full range of revenue filing services for both your business and or business owners, self employed tax returns. We manage, process and file all Revenue returns.

- VAT

- PAYE & PRSI

- P30

- P35

Australian Tax

Some of the common questions about Australian Tax that we get asked are:

- Have sold shares/property assets in Australia. What are my CGT liabilities in Australia and Ireland?

- I am selling my main residence in Australia. Can I still get Main Residence Exemption?

- What is a CGT K3 event and the possible consequences?

- I have received an inheritance from Australia. What are the tax implications both in Australia and Ireland?

- Can I still contribute to my Superannuation fund in Australia while overseas?

- Can I receive both an Australian and Irish Social Welfare Pension?

- If you have a rental property in Australia. Talk to us on the strategies to minimise your Australian tax liability.

- Talk to us if you have any question in regards to your Australian Taxes

We provided dedicated services to Australian Ex -Pats living in Ireland and can assist with the following:

- Income Tax Returns

- Tax residency queries for both Australia and Ireland

- Capital Gains Tax

- Estate Planning and Inheritance

- Superannuation

- Rental Property

- Double Taxation Agreement

Specialist Services

Company Secretary

Company legislation requires businesses to perform many administration tasks that take up a lot of valuable company time. The last thing you need as a business owner is to be stressed out trying to ensure you are complying with Company Law.

The possible threat of penalties for failing to keep up with the changing rules is too great a risk to take.

At SBL Accountants, we are able to relieve this burden from you. Our services include:

- General advice on company law

- Company formations

- Filing of annual returns on your behalf

- Preparation of all documentation related to minutes and resolutions

- Maintenance of statutory books

- Assistance in changes of directors, shareholders, addresses, and office details

- Bonus issues

- Share transfers

Estate Planning

As unpleasant as the task is, estate planning is one of the necessities of life. It allows peace of mind, knowing your hard earned assets will be dealt with in the manner you choose.

For business owners, a plan for succession of ownership is essential. We can guide you through the process of providing for business continuity.

The executor and trustee of a will is required to perform a number of duties. At SBL Accountants, we are experienced in estate planning and can guarantee that the succession plan for your assets will be abided by.

The areas involved in estate administration that we are able to assist in include:

- Meeting to discuss objectives for your estate

- Confirming assets – valuations, inventories, appraisals

- Documentation involved in estate planning

- Protecting the assets

- Paying taxes and debts

- Estate distribution

Rental Property

At SBL Accountants, we have the necessary expertise to assist in a variety of areas in relation to residential and commercial property.

The services we offer our clients include:

- Advice on the purchasing of a property

- Review of lease agreements

- Advice on funding

- Guidance in tax minimisation

- Advice on ownership structure

- Periodic reviews to ensure returns are maximised

The importance of forecasts in making a residential investment cannot be emphasised enough. We are able to provide for you:

- Forecasts of revenue returns

- Forecasts of financial position

- Forecasts of potential growth

Buying Selling A Business

Buying or selling a business can be a difficult and often disheartening process. In this state, the tasks involved in buying or selling a business can seem particularly arduous. Here at SBL Accountants, we are able to relieve that stress for you.

The services we provide in relation to organising the buying & selling of a business include:

- Obtaining comparative results

- Establishing a realistic purchase or sale price

- Taking the business to the market

- Negotiating with potential purchasers

- Drafting a contract with the assistance of our legal consultants

SBL Accountants are able to assist in such a way that a maximum return for your business can be achieved.

Sports Wealth Advisory

Your sporting career won’t last forever. With help from SBL Accountants, your wealth will.

Whether you’ve developed a successful career playing soccer, golf, rugby, boxing, horse racing, tennis, hockey or another sport, we know the special financial challenges sporting professionals face in Ireland:

- You may earn money in several currencies.

- You may have overseas residency.

- You may receive income from a variety of sources, some regular, some irregular.

- Your career earnings go through peaks and troughs.

SBL Accountants has teamed up with a leading wealth management company and sports lawyers to provide sports players with a broad range of services and advice (including accounting, legal and financial) during and beyond their sporting careers. Our focus is purely on providing independent advice, and not acting in any managing capacity of players. We aim to provide a strong objective independent, fee for service, rather than commission driven advice, to sportsman and women at any level and at any stage of life.

Whether you’re just embarking on a professional sporting career, or you’ve reached a crossroads in your career and you’re wondering what comes next, we can help you. And because we have an excellent network of industry experts working alongside us, we can ensure your accounting and taxation needs are completely integrated with your wealth creation goals.

International Service

Are you looking to set up a company in Ireland. We have assisted with the establishment of companies on behalf of our clients from Australia, Spain, France, Italy and Austria

Our services include assistance with:

- Business Company Set up

- Statutory Tax and Company registrations

- Nominee Director/Resident Director

- Referral base to other professionals

- Opening of Business Bank Account

Other Business Services including:

- Accounting & Assurance

- Business Advisory

- Taxation advisory & Compliance

- Double Taxation agreement

- Corporate Secretarial Services

- Payroll Processing & Administration